Debt settlement and bankruptcy are the two most sought after debt relief options. But, most are confused as to which is better. This is partly because of both of the options’ effect on credit, partly because of the assets and your finances. Many are of the opinion that debt settlement is a much better than filing a personal bankruptcy. Whereas, some others are of the opinion that bankruptcy is better than debt settlement.

Debt settlement – Analysis on the process

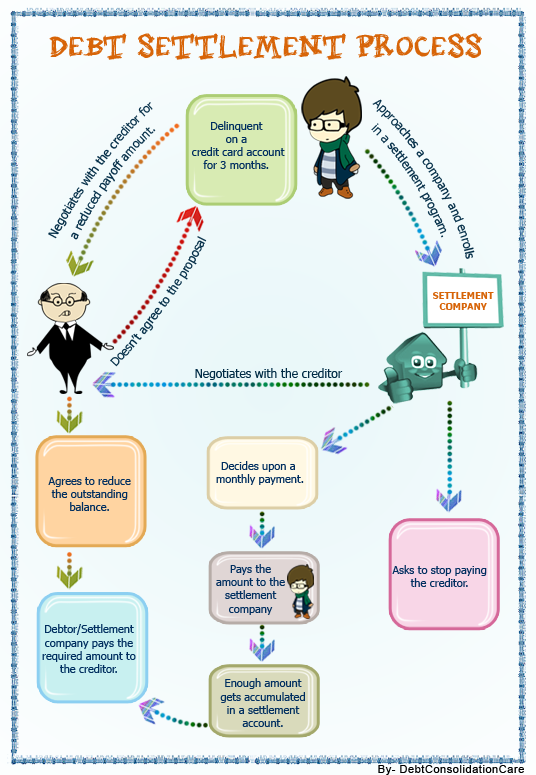

In debt settlement, the outstanding debt amount lowers by 40-60% in general. It is best for you if you have relatively high debt amounts and low finances. If you have really huge debts, you will have to talk to the creditors and negotiate on lowering the debt amounts so that you can afford to make the payments. However, it is not a legal process and the creditors are in no way legally bound to agree to your request.

Other than this, in settlement the interest continues to accrue and thus the debt amount goes on increasing. Moreover, you are required to miss payments on the credit cards and other unsecured debts before you can settle the accounts. This is because, otherwise the creditors will never believe that you have low affordability. So, your credit is hurt by few points to even several points depending on the amount of debts and the amount by which you are able to settle those.

Bankruptcy – Analysis on the process

Bankruptcy is the legal process which is administered totally by the court and the judge and lawyers. Now, as it is a legal process, the creditors and lenders are bound to agree to the statement given out by the court. When you file for bankruptcy, an immediate stay order comes into effect and puts a stop to any debt collection process, judgment, lien, garnishments and so on.

However, if you file bankruptcy, it lowers the credit score by 200-350 points at the least. So, it becomes really hard for you to get new credit after filing bankruptcy. Once you file for it, it gets listed on your credit report and stays there for 7-10 years.

Why is debt settlement better than bankruptcy?

So, debt settlement is better than bankruptcy because of various reasons. First of all, bankruptcy hurts your credit more than debt settlement. Then, bankruptcy gets listed on your credit reports more clearly than debt settlement. Creditors tend to consider bankruptcy as a more serious situation and your total inability to make the payments. Thus, they may stop from giving you the credit.

Other than this, in case of bankruptcy, (Chapter 7), you lose almost all of your assets. Though bankruptcy helps you in getting that needed freedom from debt, it provides you with a fresh start, and it takes away your assets. This is because, in case of Chapter 7 bankruptcy, the bankruptcy trustee analyzes the assets that you have and then sells those off to pay off your creditors and lenders. But this is not the case with debt settlement. You are in no way required to sell off items to pay off your creditors through the settlement. You definitely won’t like losing all of your assets to the trustee so as to become free of your financial obligations. Though it is true that Chapter 13 bankruptcy is more like the repayment plan, and you aren’t required to give up your assets, it cannot be forgotten that it hurts your credit.

Other than this, in order to decide as to which is the better option, it is first important for you to decipher your financial condition. It will depend on your finances if you will at all be able to pay off debts with the help of debt settlement. Otherwise, it may be better for you to file bankruptcy. But, if you think that you will be able to afford the payments after settlement, you definitely can opt for the settlements.